Debt settlement clears your debt with creditors for less money than you owe. Level offers an affordable solution for debt relief.

Debt settlement programs aim to significantly reduce your debt to creditors. They aim to help resolve debt problems and avoid filing for Chapter 7 bankruptcy. While there are no guarantees, clients of Level Debt can reduce their credit card balances and for some creditors as much as 45-50%, but it can vary client by client.

Creditors often see debt settlement as a form of insurance, making them more likely to recover money compared to other options. This forms a solid foundation for discussions with creditors. This gives us a solid foundation on which to open discussions with a creditor.

Debt settlement helps thousands eliminate credit card debt quickly.

Reduce monthly debt as much as 45%-50% and rebuild your financial life with this reliable option.

Clients of Level Debt typically complete their debt settlement program in 24-48 months. Settled debt may stay on your credit report for up to seven years. A Chapter 7 bankruptcy can remain on your credit report for up to 10 years.

Debt settlement isn’t difficult with the right company. Level Debt counselors analyze personal finances and fight to help you become debt-free. We advocate for you with creditors, lenders, and even yourself.

We’re here to provide encouragement, resolve, articles, and analysis to help you cast aside debt and regain control of your finances.

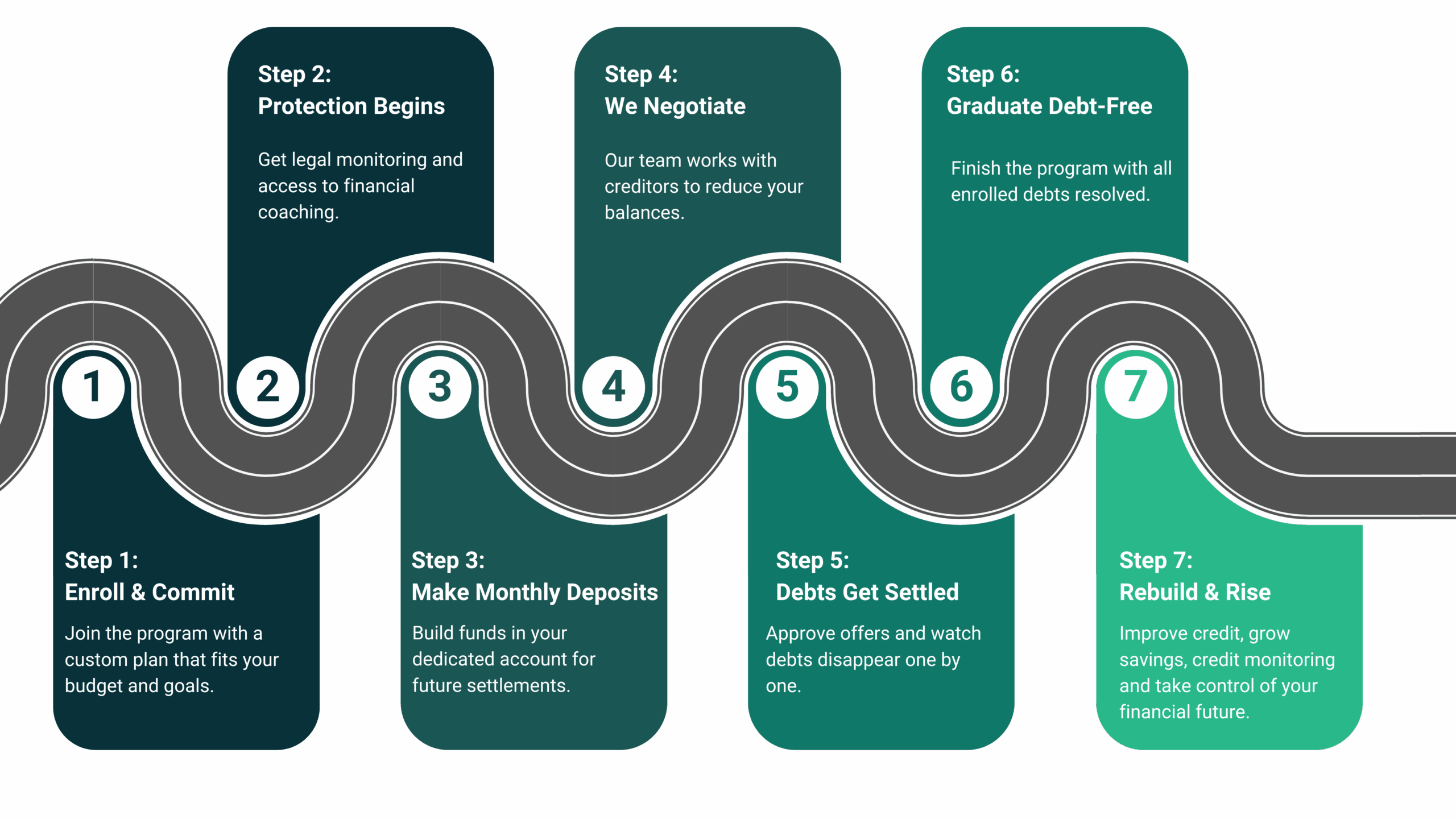

Debt settlement is based on the idea that that when debtors cannot afford to make regular monthly debt payments, creditors may accept a reduced amount as settlement. This is often seen as advantageous for them. After evaluating your credit profile, we’ll provide an estimate of how quickly we can settle your debt. Keep in mind that negotiations with creditors can be time-consuming, sometimes taking up to two years. Patience is crucial. Once you qualify for Level Debt settlement program (our review takes less than a day), you can begin transforming your financial life through a process, short of bankruptcy.

Next, you’ll transfer a smaller amount of money monthly to a dedicated savings account, which you’ll fully control. This is a key concept. Level will help determine the appropriate deposit, but the money remains yours, managed by a third party, under your control. If you decide to discontinue the process later, the money is yours to redirect as needed.

The monthly deposits to your account typically make up just 60%-70% of your minimum credit card obligations. So, apart from having more cash on hand, you’ll be on track to build the financial resources for a persuasive lump-sum settlement offer to your credit card companies.

Once you’ve saved a significant portion of your total debt balance in your dedicated account, Level will initiate the settlement-offer process with your permission. Our team is comprised of highly skilled negotiators, having dedicated countless hours on the phone with banks and other creditors, successfully settling debts for over 20,000 Level clients.

Leveraging the expertise and knowledge of our professionals works to your advantage, allowing negotiators to secure the most favorable settlement possible. Typically, Level negotiates your debt balance down to about half of what you owe, showcasing why debt settlement stands as the swiftest and most cost-effective path to debt relief without resorting to Chapter 7 bankruptcy.

Level Debt charges no upfront fees & assesses no fees until debt resolution. Fees vary by state & enrolled debt amount. Expect fees up to 25% of total debt. Debt settlement provides sensible help when you are drowning in debt. Discover the value of Level Debt solutions!

While negotiating a debt settlement yourself is possible, it can be risky. Inexperienced negotiators often lack the time and resources to handle hardball tactics used by creditors or collection agencies. This may lead to paying more than necessary. Such tactics can be dispiriting and lead to considering bankruptcy.

With Level Debt, you won’t be intimidated. We have the experience to negotiate settlements on your behalf, providing real savings and a fresh start. We invest time contacting your banks and creditors to significantly reduce your debt burden.

Our team will develop a customized plan to eliminate your credit card debt in a fraction of the time it might take on your own.

Level Debt’s experts have assisted thousands of people since 2009. Our accredited experts provide customized debt solutions and personalized service to help you achieve a debt-free lifestyle.

Knowledge is power, and understanding your debt relief options is the first step toward a future free of perpetual debt. The next step is to take action.

See if you qualify for debt settlement by taking the brief quiz below.

A debt resolution plan may not always be the optional solution. Our debt consultants will go over your current situation and see if it is the right fit for you. We partner with other service providers that offer personal loans, bankruptcy, and financial education if any of those may be a better solution.

Learn the five solutions for dealing with debt, and which one is best for you.